1. The Basics: What Defines Each

Luxury Apartment- Typically located on mid to higher floors

- Offers top-tier finishes, layouts, and premium amenities

- Designed for elegant, comfortable living with efficient use of space

- Occupies the topmost floor(s) of a tower

- Comes with expansive layouts, high ceilings, larger balconies or private terraces

- Offers greater exclusivity, views, and often customization options

2. Space & Layout

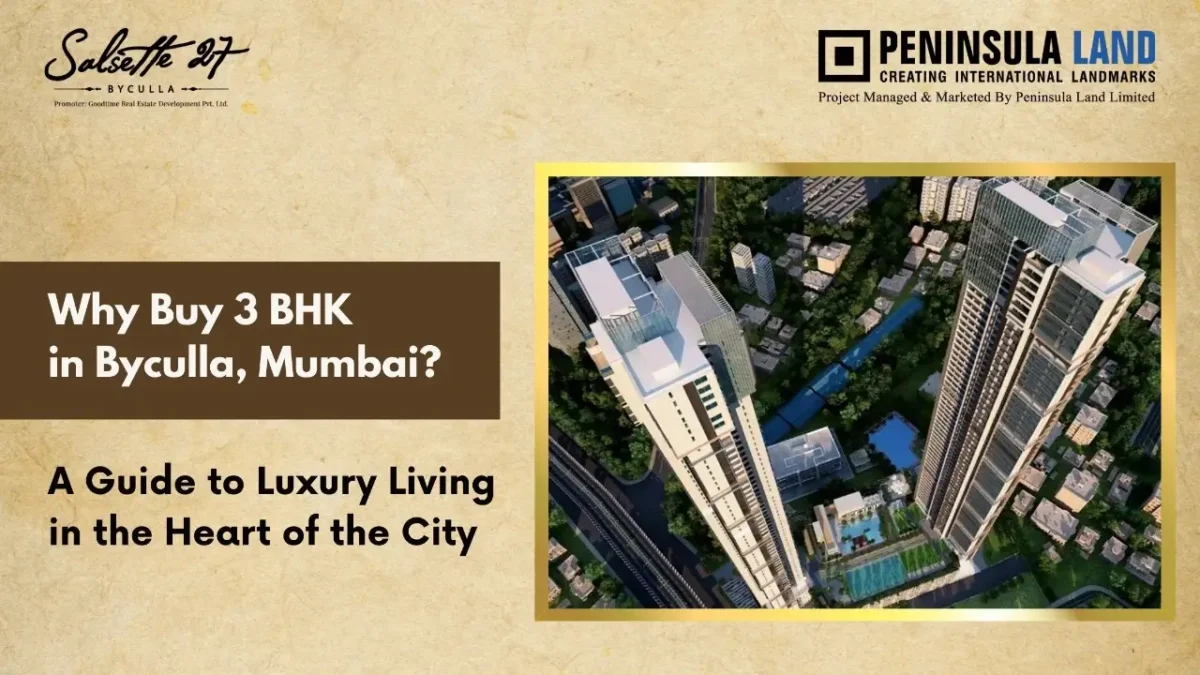

Luxury Apartment: Ideal for families or individuals looking for premium comfort with functional layouts. Typically ranges from 2 to 3 BHK at Salsette 27, with smart zoning of living and sleeping areas, balconies, and modern kitchens. Penthouse: Offers expansive layouts—often 4 BHK or more—with multiple entertainment zones, staff quarters, dual access points, and in some cases, private decks or rooftop spaces. It’s the choice for those who host, entertain, or simply want more room to breathe. Verdict: If you need generous space and custom design, go for the penthouse. If premium comfort with a manageable footprint suits you, a luxury apartment is ideal.3. Views & Privacy

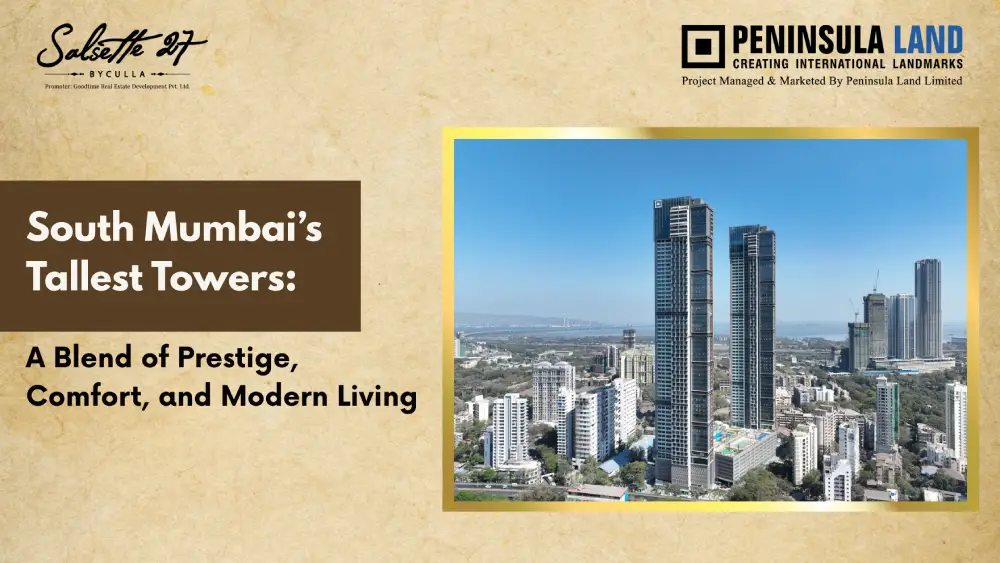

Luxury Apartment: Higher floors still offer great views, especially in a high-rise like Salsette 27, which overlooks the Arabian Sea, Mahalaxmi Racecourse, and Byculla greens. Penthouse: Unparalleled 360° views, zero obstruction, and the sense of living above it all. Additionally, penthouses often enjoy private lift lobbies, dedicated floor access, and fewer neighbors. Verdict: If privacy, peace, and views are high on your list, a penthouse wins hands down.4. Lifestyle & Statement

Luxury Apartment: Represents sophistication, smart design, and modern city living. Suitable for professionals, young families, and global investors. Penthouse: Represents success, aspiration, and elite social standing. It’s not just about living—it’s about making a statement. A penthouse is often the final upgrade for those who have achieved it all. Verdict: Choose a penthouse if you’re looking to elevate your lifestyle and express your identity. Choose a luxury apartment if comfort, convenience, and smart urban living matter more than size or status.5. Investment & Appreciation

Luxury Apartment:- Easier to sell or rent due to broader market demand

- Offers steady appreciation and high rental yields, especially in premium projects like Salsette 27

- Rarer, more exclusive, and commands a premium

- May take longer to sell but offers exceptional appreciation potential in luxury-driven markets like South Mumbai

- Highly attractive to HNIs and NRIs